“The Power to Delay”

Please explore the Internet for reasoning why the Fuel Dispenser liability shift has been postponed to 2020. See if you can identify some reasons why dispensers have been pushed off to much later than ATMs and POS terminals that have to do with something other than cost and integration problems and maybe against the best interest of the petroleum industry.

In understanding why America finally decided to abandon 1970 magnetic stripe data and turn to EMV technology, we must examine the fraud climate between 2000 and 2010 and understand the overwhelming amount of card payment fraud that was crippling America. Identity theft, skimming, network and POS intrusions, card cracking were just part of the epidemic of low tech and high tech crimes that were running rampant in the United States. The fraud damns official began to crumble with several high-profile network intrusions (Target, Home Depot) where millions of customer’s card data and personal identifying information was stolen by hackers. The financial industry had finally had enough of the outdated technology or card swiping and finally began its migration to EMV technology.

With pressure from financial institutions across the country, the “Big-4” of the payment industry finally began the migration to EMV technology in 2012. This migration would not be done overnight. There were, and still are, many complications associated with implementation, cost, and accountability as we now enter our 7th year since deciding to abandon mag stripe transactions.

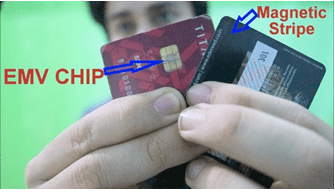

Finally, one must take a look at EMV (Chip) technology and how it works and why it is safer technology. And they’re more than one way to conduct an EMV transaction. You may be surprised by the method the majority of financial institutions chose when implementing EMV here in the U.S. So how does a small chip on the front of our cards make it safer for us to conduct a transaction? What is the “Liability shift” and what impact will it have going forward in determining who will take the losses associated with card fraud going forward?

Come explore the “changing of the guard” in one of the most dynamic transformations in the history of payment methods in the U.S.