Assignment Tasks: Answer all questions

SUPPLEMENTARY INSTRUCTIONS

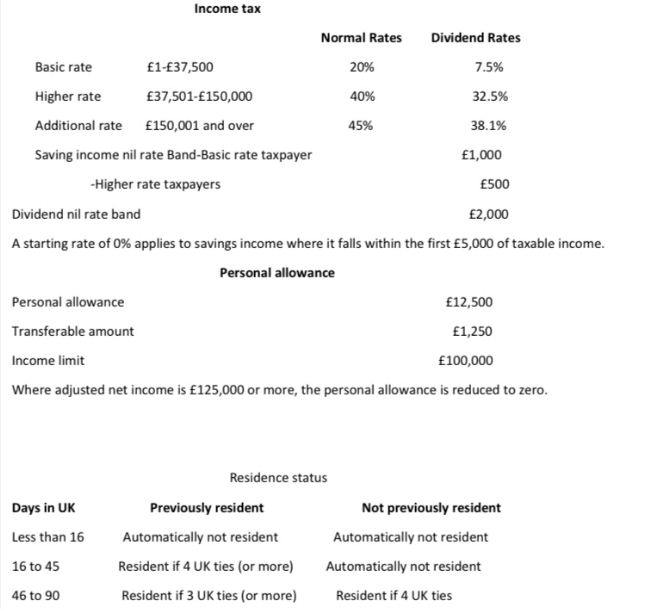

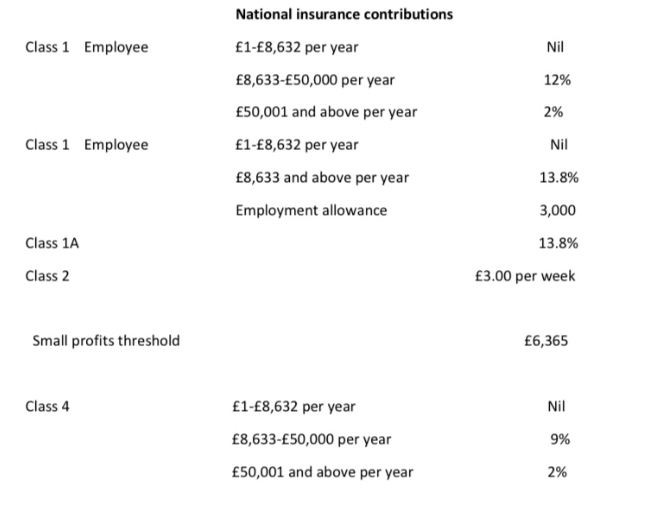

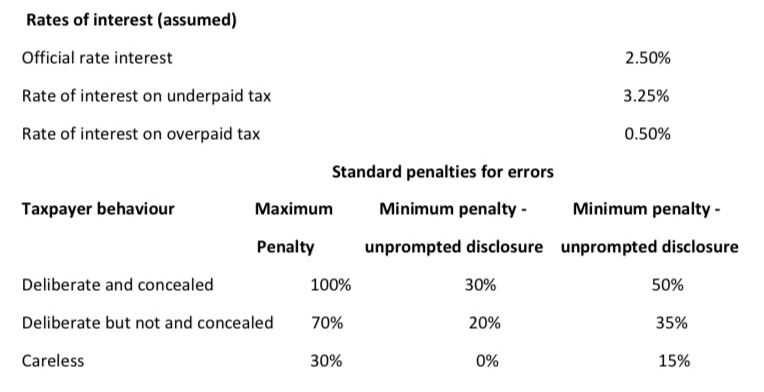

Tax rates and allowances

The following tax rates and allowance are to be used in answering the questions.

91 to 120 Resident if 2 UK ties (or more) Resident if 3 UK ties (or more)

121 to 182 Resident if 1 UK tie (or more) Resident if 3 UK ties (or more)

183 to more Automatically resident Automatically resident

Child benefit income tax charge

Where income is between £50,000 and £60,000, the charge is 196 of the amount of child benefit received for every £100 of income over £50,000

Car benefit percentage

The relevant base level CO2 emissions are 95 grams per kilometre.

The percentage rates applying to petrol cars with c02 emissions up to this level are:

50 grams per kilometre or less 16%

51 grams to 75 grams per kilometre 19%

76 grams to 94 grams per kilometre 22%

95 grams per kilometre 23%

Car fuel benefits

The base figure for calculating the car fuel benefit is £24,100

Company Van benefit

The company van benefit scale charge is £3430, and the van furl benefit is £655

Individual saving accounts (ISAs)

The overall investment limit is £20,000

Property income

Basic restriction applies to 75% of the finance cost relating to residential properties.

Pension scheme limit

Annual allowance £40,000

Minimum allowance of £10,000

Income allowance £150,000

The maximum that can qualify for tax relief without any earning is £3,600.

Approved mileage allowance: cars

Up to 10,000 miles 45p

Over 10,000 miles 25p

Capital allowance: rates of allowance

Plant and machinery

Main pool 18%

Special rate pool 6%

Motor cars

New cars with CO2 emissions up to 50 grams per kilometre 100%

CO2 emissions between 51 and 110 grams per kilometre 18%

CO2 emissions over 110 grams per kilometre 6%

Annual investment allowance

Rate of the allowance 100%

Expenditure limit £1,000,000

Cash basis accounting

Revenue limit £150,000

Cap on income tax reliefs

Unless otherwise restricted, relief is capped at the higher of £50,000 or 25% of income.

Corporation tax

Rate of the tax-Financial year 2019 19%

- Financial year 2018 19%

- Financial year 2017 19%

Profit threshold £1,500,000

Value added tax (VAT)

Standard rate 20%

Registration limit £85,000

Deregistration limit £83,000

Inheritance tax: tax rates

Nil rate band £325,000

Residence mil rate band £125,000

Rate of tax on excess- Lifetime rate 20% – Death rate 40%

Years before death Percentage reduction

Over 3 but less than 4 years 20%

Over 4 but less than 5 years 40%

Over 5 but less than 6 years 60%

Over 6 but less than 7 years 80%

Capital gains tax

Normal Rates ResidentialProperty

Lower rate 10% 18%

Higher rate 20% 28%

Annual exempt amount £12,000

Entrepreneurs’ relief and investors’ relief:

- Lifetime limit £10,000,000

- Rate of tax 10%

SECTION A

Question 1

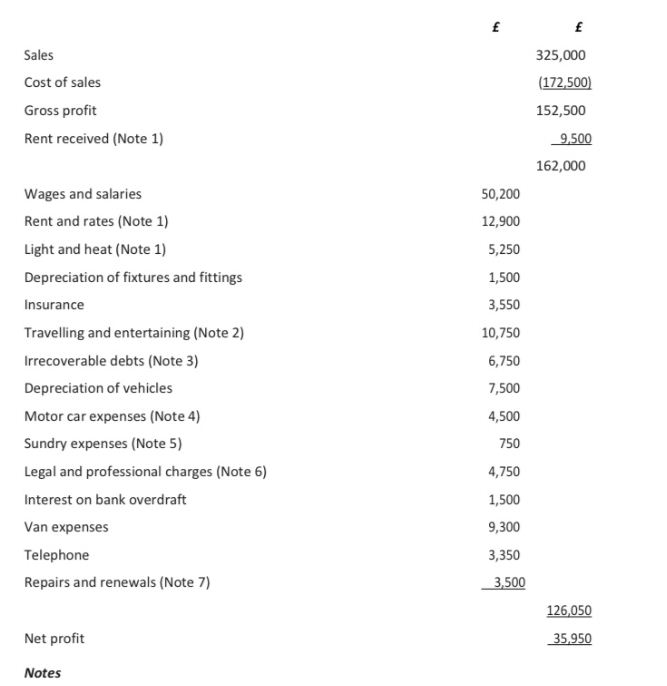

For the past five years, John has run a business importing electrical goods from the Far East which he then sells to wholesalers H the UK. His statement of profit or loss for the year ended 31st December 2019 as follows:

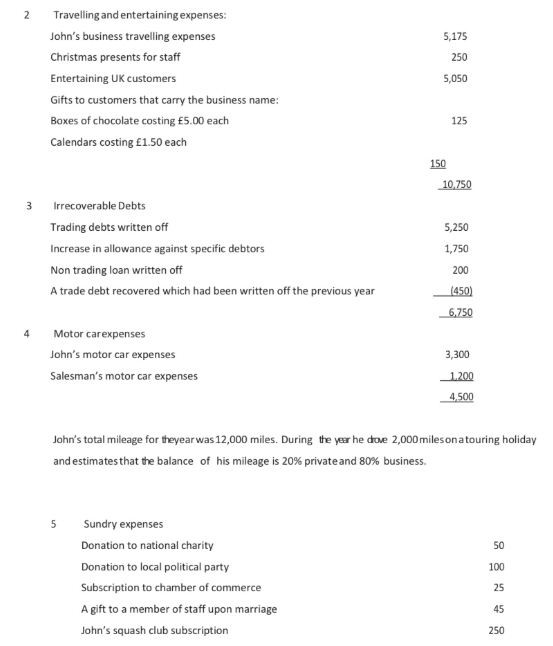

1. Rent received is in respect of a flat above John’s business premises that are rented out. John estimates that a tenth of the rent and rates, and a seventh of the light and heat is in respect of this flat.

During the year ended 31. December 2019 John took various electrical goods out of stock for his own and his family’s use without paying for them. These goods cost £450 and would have normally been sold at a mark-up of 30%.

John has a room in his private house that He uses as an office as he often works at home. The allowable amount for the use of the office is £250 and appears to be a fair estimate. Also, John makes business calls from his private telephone and he estimates the business use as two-fifths. The total of his private telephone calls for the year was £450.