1) As a senior vice president of a major consumer products corporation, you have been asked to review the following investment and advise the CEO whether it should be pursued. The investment involves buying a bottle manufacturer and making it a subsidiary of your beer division. The acquisition will benefit the firm by providing a reliable internal source of bottles. The acquisition price will be $3,500,000. The bottle company has tangible assets of $2,500,000 and debt of $1,000,000 which must be paid off by the parent corporation (for a total of $4,500,000 in cash outlays). If the transaction occurs, the beer division will also acquire an intangible asset of $2,000,000 to reflect the premium paid for the bottler. That intangible asset must be amortized over five years, resulting in an expense of $400,000 per year. The company will also have depreciation expense of $200,000 per year for the next ten years on the bottler’s property, plant, and equipment. No new equipment will need to be purchased during the operating life of the bottling plant. The company would have to make some changes at the bottling plant in the first year following the acquisition to optimize it for producing bottles for its beer plant. Those changes will cost $300,000 (and will be expensed immediately).

On the plus side, the bottling plant will produce 20 million bottles per year at a variable cost of $0.12 per bottle and a fixed outlay cost of $1,500,000 per year. Currently, the beer division pays $0.25 per bottle and has sufficient volume that it can use as many bottles as the bottling plant can produce. The bottling plant is expected to operate for ten years following acquisition before it becomes obsolete. At that point, it can be scrapped and the land sold, yielding $1,000,000 (received in December 2028), for a gain on sale of $500,000.

If the firm buys the bottler, the transaction will take place on December 31, 2018, with the new operations affecting the company starting in 2019. By convention, costs and benefits received throughout a year are treated for present value purposes as occurring at the end of that year. There are no taxes and the firm’s discount rate is 10 percent.

Determine the net present value and NPVI for the corporation if it buys the bottling company. (Use 2018 as year 0.)

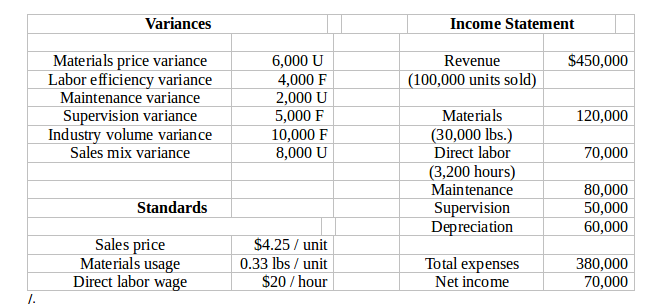

2) [Hint: review exercise 17 available on CCLE for a similar problem to this.] You’re the controller at X Corp. Your accounting staff has just provided you with a list of variance calculations that you requested. Unfortunately, they forgot to calculate some variances that you wanted, and even worse, they neglected to provide you with the original budget data that you also requested. It’s 8 PM, and everyone has gone home already. You have an actual income statement and have scrounged your desk to find some information on standards that the company used in developing the budget. You need to prepare a presentation for tomorrow morning and don’t want to admit that you can’t find your own budget. You resolve to reconstruct it.

Depreciation and supervision are fixed costs; the others are variable. Depreciation was known with certainty at the time of budgeting for all pre-existing PP&E. The company bought a new machine during the year that added an unexpected $4,000 to depreciation. The company’s market share for the year was 1%, but had been budgeted to be 1.2%.

a) Reconstruct the original budgeted income statement.

b) The purpose of tomorrow’s meeting is to discuss your strategy for variance investigation. Your staff is small, and you can only adequately investigate two variances. Which two will you pick, and why? Note that you are in no way constrained by the selection of variances provided above by your staff. You can choose any variance to investigate, after you have calculated it. Please keep your explanations brief.

3) Jenny is the president of the West division of Courland Inc. In December she reviews the division’s projected accounting statements for the year. If she does nothing, she expects the division to have $5 million in revenue, $2.4 million in variable costs, and $1.6 million in fixed costs, on volume of 100,000 units. The division has $6 million in assets. Courland has a cost of capital of 12%.

a) Calculate the projected value of the West division’s ROI and RI.

b) Jenny will receive a $100,000 bonus if she can achieve an ROI of 18%. Clearly, she would like to do that. She considers the following schemes to earn the bonus. Answer the question provided for each of these schemes. [Note that all of these are unethical. I do not advocate their use, but even if you would never do such a thing yourself, it is important to understand the incentives to cheat that performance measures can produce since other people are not so pure.]

I) West division could ship a lot of extra product to customers at year-end (called channel stuffing). Assume the extra products sell at the typical price and have the typical variable cost. How many extra units would West division need to sell to reach the ROI target?

II) West division could defer some of its costs (such as maintenance) until next year. This would decrease fixed costs this year. How much fixed cost would need to be deferred to reach the ROI target?

III) West division could hide some of its assets from the year-end balance sheet. There are several ways to do that (e.g., repurchase agreements, special purpose entities, or early pay down of operating liabilities). How much assets would need to be hidden to reach the ROI target?

4) A particular machine in your factory is used to make two products, X and Y. Each day, the machine can process a maximum of 40 batches. A single batch of X is 100 units. X sells for $10 per unit (and we can sell an unlimited amount at that price) with a variable cost of $4 per unit and a daily fixed cost of $5,000. A single batch of Y is 50 units. The variable cost of Y is $7 per unit, with a daily fixed cost of $6,000.

a) Based on the production of X, what is the shadow cost of one batch produced by the machine?

b) What is the minimum price we need to charge for a unit of Y so that its contribution margin is not negative? (Take opportunity cost into account.)

c) Assume that we are capable of selling 800 units of Y each day for $25 each. Further assume that 75% of the fixed cost of Y could be avoided if we dropped the product. What is the daily differential profit of dropping Y production?

d) Assume instead that Y has a downward sloping demand curve with V = 6,000 – 200P. Determine the optimal price to charge for Y to maximize total factory profits.