Question 1 (10%).

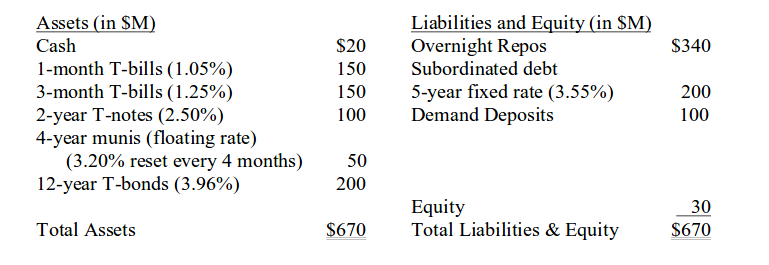

Consider a hypothetical government security dealer named Banana Republic with the following balance sheet information. Market yields are in parentheses.

a. What is the repricing gap if the planning period is 91 days?

b. What is the impact over the next 91 days on net interest income if all interest rates decrease by 25 basis points?

c. Suppose, the following one-year runoffs are expected: $20 million for two-year T-notes, and $40 million for 12-year T-bonds. What is the one-year repricing gap?

d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates decrease by 25 basis points?

Question 2 (20%).

Consider a financial institution with a bond portfolio comprised of sovereign country debt that has both interest rate and exchange rate risk exposure. The duration of assets is 3.4 years and the duration of liabilities is 5.2 years. The portfolio has assets of US$18 billion (including 2.5 billion euro) and liabilities of US$16 billion (including 4.15 billion euro) with no other currencies bought or sold forward.

a. What is the interest rate risk of the bond portfolio?

b. What is the foreign exchange rate risk of the bond portfolio?

c. If there is only a 1% chance that interest rates will decline 10 basis points or more tomorrow, what is the dollar daily value at risk at the 1% level?

d. If there is only a 1% chance that US dollar/euro exchange rates will increase by at least US$0.25 per euro tomorrow, what is the daily dollar value at risk at the 1% level?

e. What is the 1% dollar VaR for both interest rate and currency risks if the correlation between the risk exposures is –0.05?

Question 3 (20%).

You have been hired by a local Polish bank to help them design a bond portfolio to fund a $10 million pension obligation that will come due in 4 years. The managers of the bank would like to use a 2-year zero coupon bond along with an 8-year zero coupon bond to fund this obligation. Suppose that the yield curve is flat so that the yields to maturity on all zero coupon bonds are 5%.

(a) Design a portfolio of the two bonds that will protect the pension from fluctuations in interest rates. Provide both the current percentage and monetary positions in this portfolio.

(b) Suppose, that right after you create this portfolio, the yield curve shifts to 6% at all maturities. Calculate what you expect the future value of the investment in the two bonds to be in year 4. Do you meet the obligation of the bank? Explain any difference.

Question 4 (50%).

This problem requires the use of excel spreadsheet that you should include with your answers (clearly mark it with your last name). However, your final recommendation should be provided in a format of a written document/memorandum (paste any figures/tables that support your points into the report). In writing your report, whenever necessary, clearly refer to any specific calculations in the spreadsheet. You do not need to provide detailed definitions of risk measures as long as they follow the standard of what we used in class.

A large all-equity pension fund company with AUM of $500Billion that is closely following S&P 500 index is facing a possibility of new regulatory changes in its management of market risk. The new regulation would require capital charges to cover possible tail event losses based on the realistic assessment of market risk of the company. A CRO of the fund is given a task to assess a range of possible costs with regard to such charges.

It turns out that the CRO of the fund is an old buddy of yours from school times and regards you as a world-class expert. With no hesitation she then turns to you for help. Given your close friendship (and a hefty paycheck she offers) you eagerly decide to provide feedback.

In your recommendation, you may want to consider the following:

– access to daily price data of the S&P 500 index (attached data_exam.xlsx)

– various choices of risk measures

– specificity of the data in terms of its distribution and volatility structure

– tradeoffs between profitability and risk of the implemented charges

– possible adjustments in the portfolio strategy

– supporting your answers with graphs/tables