Question 1

We have often heard of the statement “high risk, high return” in risky investments and have taken it to be correct, as it sounds intuitively correct. However, is it reflective of the observed trend of risky investments, such as the stock markets?

In this GBA, we will examine the validity of the “high risk, high return” statement by constructing risky portfolios from stocks. The portfolios are of varying volatility levels (i.e. different risk levels) and we will determine the resulting trend observed from the returns of the portfolios.

Return is formulated as

where Si(t) and Si(t-1) are the prices of stock i on the day t and t-1 respectively. Risk is measured using the sample standard deviation of the daily returns, i.e

is the mean return of stock i and N is the number of return data points. You are given the daily return data for 2000 stocks, for a period of 30 years in the file named ret.csv.

Make use of Python, especially the pandas module to implement the portfolio construction described in Appendix A. The breakpoints indicated that you are to construct five (5) portfolios, where the first portfolio consists of all stocks whose volatilities are between the 0 and 20th percentile, the second portfolio consists of all stocks whose volatilities are between the 20th and 40th percentile. The fifth portfolio will consist of all stocks whose volatilities are greater than the 80th percentile.

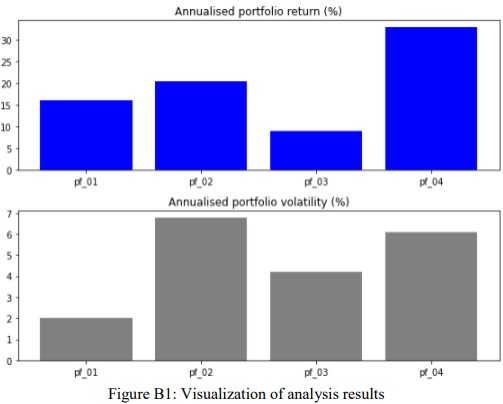

You are to present your results using a series of plots shown in Appendix B. If necessary, state clearly any assumptions you have made in your implementation. You are to conclude clearly if the statement “high risk, high return” is observed in your analysis, using the data given.

For marking and evaluation purposes, you are to document/print the following information in your Jupyter notebook submission:

(a) the name of the main developer for each section of code/function

(b) the daily return of s_0520 and s_1080 on the last trading date of Jun and Sep 2018.

(c) the volatility of daily return for s_0125 and s_1050 in Jan and Dec 2010.

(d) the monthly return of s_0250 and s_1900 in Apr and Nov 2013.

(e) the last 5 stocks in the second portfolio were created in Feb 2015.

(f) the realized monthly return of the first and third portfolios in Feb and Nov 2008.

(g) the annualized return and volatility of all portfolios are presented in 2 decimal points (i.e.3.24%) for the entire analysis period.

You are reminded to practice good programming habits in your implementation and your code must be driven entirely off the inputs given in Figure 1.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Appendix A

You are given the daily return information of 2000 stocks and using this information, you are to determine the volatility of all the stocks for month k, at the last trading date in the month, using the daily return information in the month. In month k, the volatility is calculated using Equation (2) and the stocks are then ranked according to their volatility level. The stocks are then sorted into different portfolios, dependent on the breakpoints provided by the user in Figure 1. An equal-weighted (EW) portfolio is created using the stocks.

The stocks will be held for a month. In a month (k + 1), the return of the EW portfolio is realized. The process of sorting stocks according to their volatility is repeated and new portfolios will be created. Again, the portfolio will be held for a month. This process will repeat till the end of the data.

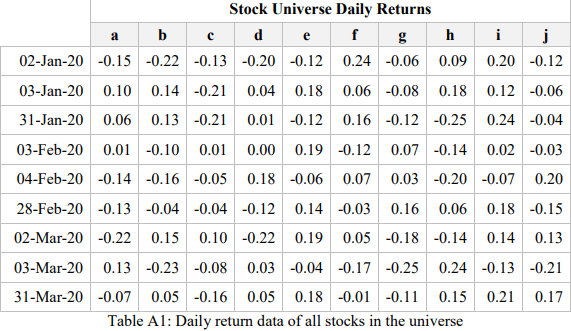

A numerical example is provided for 10 stocks in the universe. To simplify the example, the 10 stocks are assumed to only trade for 3 days in a month. Three portfolios are created with the following breakpoints:

breakpoints = [30, 70]

The daily return of stocks in the universe is presented in Table A1

On the 31-Jan-20, the volatilities of all the stocks in the universe is calculated and the stock with the lowest volatility is g, whose volatility is 3.1%. The stock with the highest volatility is h, whose volatility is 22.7%.

The stocks are sorted, and stocks c, g and j are allocated to the first portfolio which corresponds to the first breakpoint of the 30th percentile and the portfolio is constructed with equal allocation from the stocks.

Stocks b, e and h are allocated to the third portfolio which corresponds to the breakpoint greater than 70th percentile. Again, the allocation of each stock in the portfolio is 33.33% each.

All the portfolios were held for a month. For stock c in the first portfolio, daily returns of 0.01, -0.05 and -0.04 were experienced in Feb-20. The monthly return for stock c in Feb-20 is – 7.9% (=1.01*0.95*0.96 – 1).

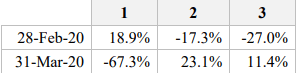

Hence, the monthly return for the first portfolio in Feb-20 is 18.9%. The stock sorting and portfolio construction is repeated monthly, using the daily return of the stock universe. With the data given, the monthly returns of the three portfolios are summarized in Table A2.

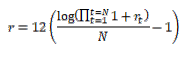

With the given daily return data, 3 portfolios can be constructed on the 31-Mar-20. However, the monthly return of the portfolios constructed on the 31-Mar-20 cannot be evaluated as the data for Apr-20 is not available. The annualized return of the portfolio can be calculated as follows:

where rt is the time series of the monthly returns of portfolios and N is the number of terms in the time series.

The annualized volatility of the portfolio is calculated as follows

where σr is the standard deviation of the time series of monthly returns of a portfolio

Appendix B

The results of the analysis are to be represented in accordance with Figure B1 for easy visualization. Note that dummy numbers are used in the generation of Figure B1.