Question

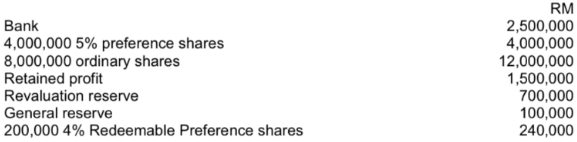

The following balances were extracted from the book of Cold Bhd as of 31 December 2020:

On 1 January 2021, the company decided to issue 200,000 preference shares and 2,000,000 ordinary shares at RM1.40 and RM2 each respectively. The shares were fully subscribed and fully paid.

On 1 September 2021, the company decided to redeem all the redeemable preference shares. In order to facilitate the redemption of the preference shares, the company decided to issue 100,000 ordinary shares at RM1.40 The director of the company agreed that the redeemable preference shares will be redeemed partly by the issue of new shares and partly out of profits. All the reserves remain the same except that the current year’s net profit in 2021 was RM600,000.

On 1 June 2022, the company decided to issue a bonus share on the basis of 2 new ordinary shares for every 10 existing ordinary shares held in the year 2022. The directors decided to write off 40% of the bonus issue amount from the revaluation reserve and the remaining from other reserves.

On 1 December 2022, the company decided to make a rights issue of shares on the basis of 1 new ordinary share for every 20 existing ordinary shares held at the share price of RM1.80. The market price of the share was RM2 each. Assume that, all the reserves remain the same from the year 2022 except that the current year’s net profit in 2015 was RM550,000.

Stuck in Completing this Assignment and feeling stressed ? Take our Private Writing Services.

The post Accounting Assignment, UM, Malaysia On 1 January 2021, the company decided to issue 200,000 preference shares and 2,000,000 ordinary shares at RM1.40 appeared first on Assignment Helper.