Question 1 Mr. Kao is a qualified accountant but obtained his qualification some years ago. He has heard that accounting for changes in group structures is somewhat different from what it used to be. “It all used to be very straightforward. Each acquisition attracted a bit more goodwill. There was an extra purchase and so …

Continue reading “Mr. Kao is a Qualified Accountant But Obtained His Qualification: Financial Accounting Assignment, SMU”

The post Mr. Kao is a Qualified Accountant But Obtained His Qualification: Financial Accounting Assignment, SMU appeared first on Assignment Help Singapore No 1 : Essay & Dissertation Writers, SG.

Question 1

Mr. Kao is a qualified accountant but obtained his qualification some years ago. He has heard that accounting for changes in group structures is somewhat different from what it used to be.

“It all used to be very straightforward. Each acquisition attracted a bit more goodwill. There was an extra purchase and so more goodwill was bought as each purchase was of a bit more of the business. Obviously, the cost of the advisor’s fees would be included in this calculation as it is a cost of the purchase. I can’t see how things can be that different now.”

Required:

- Explain to Mr. Kao how the purchase of an extra 20% stake in an entity, when the group already holds 60%, is now accounted for under SFRS(I)3.

- Explain to Mr. Kao how a decrease in ownership from 80% to 60% should be accounted for and why.

- Kao is still confused and doesn’t understand how this would be applied when an entity holds an associate and then increases its holding to one of a subsidiary.

“I’m not sure I understand this yet. When I hold 40% of an entity, there is goodwill included as part of the associate; does that mean I do exactly the same thing for a purchase which takes my holding from 40% to 60%?”

Explain the rules to Mr. Kao.

Buy high-quality essays & assignment writing as per particular university, high school or college by Singapore Writers

Chat Now

Question 2

In April 20×4, B Ltd paid $30,000 to acquire a 30% interest in C Ltd, when C Ltd was incorporated with a paid-up capital of $100,000 comprising 100,000 ordinary shares.

In December 20×4, B Ltd paid $45,000 to acquire an additional 30% interest in C Ltd so as to control C Ltd, when the fair value of C Ltd’s identifiable net assets was represented by share capital of $100,000 and retained profit of $50,000, and the shares of C Ltd were valued at $1.50 per share.

In May 20×5, B Ltd paid $80,000 to acquire an additional 30% interest in C Ltd, when the fair value of C Ltd’s identifiable net assets was represented by share capital of $100,000 and retained profit of $150,000, and the shares of C Ltd were valued at $3.00 per share.

In June 20×6, A Ltd paid $400,000 to acquire a 60% interest in B Ltd when the fair value of B Ltd’s identifiable net assets was represented by share capital of $100,000 and retained profit of $300,000. On this date, C Ltd’s retained profit was $300,000.

In July 20×7, A Ltd paid $20,000 to acquire a 40% interest in D Ltd, when the fair value of D Ltd’s identifiable net assets was represented by share capital of $100,000 and accumulated loss of $30,000.

The companies had adopted, for all the relevant years, the Singapore Financial Reporting Standards that were issued by the Accounting Standards Council as of 1 January 2020.

The group policy was to measure non-controlling interests at the acquisition-date based on their proportionate share of the fair value of identifiable net assets of subsidiaries acquired.

In January 20×8, A Ltd sold a piece of freehold land (which was carried in its books as property, plant, and equipment at cost of $200,000) to B Ltd for $300,000. As at 31 December 20×8, the land was still being used as property, plant, and equipment by B Ltd.

In February 20×8, A Ltd sold another piece of freehold land (which was carried in its books as property, plant, and equipment at cost of $100,000) to D Ltd for $110,000. As at31December 20×8, the land was still being used as property, plant, and equipment by DLtd.

All the dividends were declared out of the 20×8 profits and had been duly paid and received. There were no other inter-company transactions and events. The tax rate applicable to all the entities was 20%.

The 20×8 financial statements of the companies are as follows:

Balance Sheets as of 31 December20x8

| ALtd $’000 | B Ltd $’000 | CLtd $’000 | DLtd $’000 | ||||

| Land, at cost | 500 | 300 | 100 | 110 | |||

| Investment in B Ltd, at cost

Investment in C Ltd, at cost |

400

– |

–

155 |

–

– |

–

– |

|||

| Investment in D Ltd, at cost | 20 | – | – | – | |||

| Other assets | 580 | 445 | 600 | 190 | |||

| 1,500 | 900 | 700 | 300 | ||||

| Share capital | 500 | 100 | 100 | 100 | |||

| Retained earnings/ (accumulated losses) Liabilities | 840

160 |

600

200 |

500

100 |

(45)

245 |

|||

| 1,500 | 900 | 700 | 300 |

Statements of Comprehensive Income for the year ended 31 December20x8

| ALtd $’000 | BLtd $’000 | CLtd $’000 | DLtd $’000 | |

| Sales | 500 | 400 | 300 | 200 |

| Less cost of sales | 200 | 100 | 80 | 100 |

| Gross profit | 300 | 300 | 220 | 100 |

| Add dividend income | 60 | – | – | – |

| Add profit on sale of land | 110 | – | – | – |

| Less operating expenses | 170 | 50 | 100 | 110 |

| Profit/(loss) before tax | 300 | 250 | 120 | (10) |

| Less tax | 60 | 50 | 20 | – |

| Profit/(loss) after tax | 240 | 200 | 100 | (10) |

| Other comprehensive income | – | – | – | – |

| Total comprehensive income | 240 | 200 | 100 | (10) |

Statements of changes in equity (partial) for the year ended 31 December20x8

| Retained profit/(accumulated losses) | ALtd $’000 | BLtd $’000 | CLtd $’000 | DLtd $’000 |

| Beginning balance | 800 | 500 | 400 | (35) |

| Add profit/(loss) for the year | 240 | 200 | 100 | (10) |

| Less dividend | 200 | 100 | – | – |

| Ending balance | 840 | 600 | 500 | (45) |

Required:

- Prepare all the consolidation journal entries necessary for the preparation of the Consolidated Statement of Comprehensive Income, the Consolidated Balance Sheet, and the Consolidated Statement of Changes in Equity for A Ltd group for the year 20×8 (the consolidated financial statements are not required).

- Provide independent calculation of the following items in the consolidated financial statements of A Ltd group for the year20x8.

- Profit after Tax attributable to the shareholders of ALtd,

- Profit after Tax attributable to the Non-controllingInterests,

- Retained Profit in the Consolidated balance sheet,

- Non-controlling Interests in the Consolidated balance sheet,

- Goodwill on Consolidation in the Consolidated balance sheet, and

- Investment in Associate in the Consolidated balance sheet.

Question 3

Company S approved a plan that grants its top 10 executive management staff options to acquire 100,000 shares each of the ordinary shares of its parent, Company P, at $10.00 per share.

The options were granted on 1 January 20×1 and will vest on 31 December 20×2. The options may be exercised from 1 January 20×3 to 31 December 20×3.

The company and the group adopt 31 December as their financial year-end.

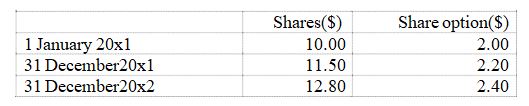

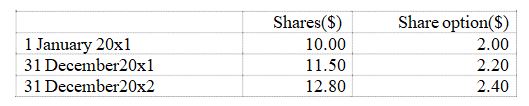

The market prices of the shares and the estimated fair values of the share option were as follows:

All the employees exercised their options in December 20×3 when the shares were traded at an average of $12.50 per share.

Required:

- Prepare the journal entries in the books of Company S for the financial years 20×1, 20×2, and 20×3.

- Prepare the consolidated journal entries in the consolidated financial statements of Company P for the financial years 20×1, 20×2 and20x3.

- Repeat requirement (a) and (b) if Company P approved a plan that grants its subsidiary Company S’s top 10 executive management staff options to acquire 100,000 shares each of the ordinary shares of Company P, at $10.00 per share. (All other facts of the case remain the same)

The post Mr. Kao is a Qualified Accountant But Obtained His Qualification: Financial Accounting Assignment, SMU appeared first on Assignment Help Singapore No 1 : Essay & Dissertation Writers, SG.