Apply these below requirements on the attached (5) five annual reports:

Required:

- Explain the presentations of intangible assets presented in the statements of financial position. Determine/Suggest the decisions that the investors or shareholders may take based on this information. Determine the decision would be difficult to take on the basis of just this information.

- State the notes to the accounts (if any) relating to intangible assets. Explain how do they enlarge the decision analysis possibilities offered to shareholders and investors. Show any impairment of the asset for the year.

- Determine the estimated useful lives (if any) of the major categories of intangible assets in each firm. Determine the treatment on the indefinite/finite useful lives of the assets. Show the computation of the amortization and impairment loss (if any)

- Compute the weight of tangible assets as a percentage of the total assets of each firm. Elaborate the strategic implications would an investor derive from this ratio.

- Determine the disclosures of the Investment Properties owned by the companies. Show any transfer of asset from MFRS 140 to MFRS 116/MFRS 102 and vice versa.

- Determine the accounting treatment under MFRS 136 of these industries. Show the impairment loss presented in the annual report for the tangible assets and intangible assets (MFRS 16, MFRS 140, MFRS 138 and MFRS 16).

Take professional academic assistance & Get 100% Plagiarism free papers

Chat Now

Company (1): ppb group Berhad annual report 2019

Intangible assets

- Goodwill represents the excess of the cost of acquisition over the Group’s interest in the net fair value of the identifiable assets, liabilities and contingent liabilities of the acquiree. After initial recognition, goodwill is measured at cost less accumulated impairment losses, if any. Goodwill is not amortized and is reviewed for impairment, annually or more frequently if events or changes in circumstances indicate that the carrying values may be impaired.

- Computer software and film rights

- Measurement basis

Computer software and film rights acquired by the Group are stated at cost less accumulated amortisation and impairment losses if any. Computer software and film rights are derecognised upon disposal or when no future economic benefits are expected from their use or disposal. On disposal, the difference between the net disposal proceeds and the carrying amount is recognised in the income statement.

- Amortisation

Amortisation is calculated to write off the depreciable amount of computer software on a straight-line basis over its estimated useful life. The principal annual rate used is 25%. Film rights are amortised based on the total revenue stream expected to be generated from the different titles and upon the exploitation of the rights. The amortisation period and the amortisation method are reviewed, and adjusted if appropriate, at the end of each reporting period.

Company (2) PRESS METAL ALUMINIUM HOLDINGS BERHAD

Intangible assets

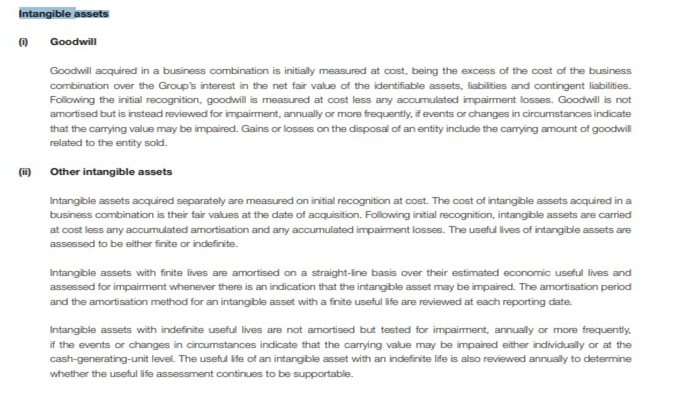

- Goodwill

Goodwill which arises on business combinations is measured at cost less any accumulated impairment losses.

- Other intangible assets

Intangible assets, other than goodwill, that are acquired by the Group, which have finite useful lives, are measured at cost less any accumulated amortisation and any accumulated impairment losses.

Company (3) MISC BERHAD

Company (4) HARTALEGA HOLDINGS BERHAD

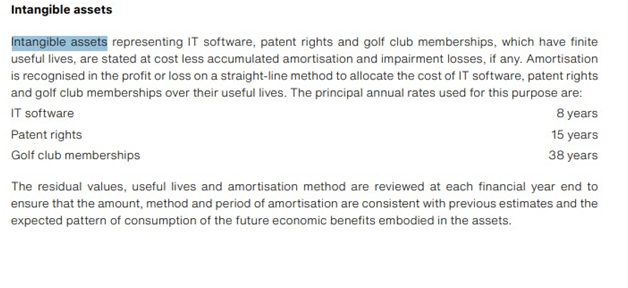

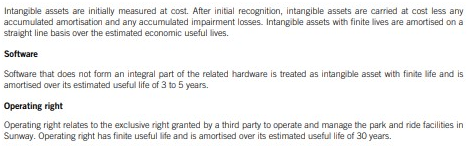

Company (5) SUNWAY BERHAD

The post Goodwill Represents the Excess of the Cost of Acquisition Over the Group’s: Advanced Financial Accounting Assignment, CU, Malaysia appeared first on .