Part 1

Changes in macroeconomic indicators can often be of relevance to business and influence decision-making concerning a range of issues related to things like profit forecasts, expected sales growth, expansion plans, etc.

Assume you are employed as a business analyst with a large Singaporean based multinational corporation that manufactures electronic products. Identify and discuss how each of the following macroeconomic issues may be relevant to the firm:

- Rising unemployment in Singapore and other developed nations.

- Depreciation of the Singapore dollar relative to other major currencies.

- A major export market where electronic goods are sold experiences accelerating inflation.

- Intellectual property (IP) protections are abolished.

Part 2

Answer the following questions:

- Identify key assumptions underlying Keynesian and Classical approaches to macroeconomic analysis.

- What differences emerge between Keynesian and Classical economists regarding understanding the business cycle and how the economy should best be managed?

- Present an argument where you express support for either a Keynesian approach OR a Classical approach. You should make a case in arguing for only ONE of these two different approaches. To support your argument draw on real-world examples and/or evidence that you cite in your answer and include in the reference list at the end of your assignment.

Part 3

Assume the following information for an economy:

Natural level of output = $128b

C = 13 + 0.6(Y)

Investment = 16

Government spending = 19

Autonomous taxation = 5

Marginal tax rate = 0.16

Exports = 34

Imports = 32

Marginal propensity to import = 0.08

Based on this information answer the following questions:

- Calculate the output ratio for the economy.

- Using the Phillips Curve illustrates the current approximate position for the economy and identifies this as point A.

- Assume the government increased spending by $2b. Calculate what the new equilibrium level of output will be.

- As a result of 3) indicate how this will likely impact the economy using the Phillips Curve model from 2). Label the new position the economy will approximately be at as point B.

- Discuss whether the government actions3) are consistent with the objectives of economic stabilization. Include within your discussion reference to what the goals and objectives of economic stabilization entail.

Part 4

In topic 8 we explored the important topic of productivity and growth. Based on what you have learned from this topic, apply some of the key principles including relevant theoretical premises that can assist in understanding Singapore’s significant levels of economic growth and development over recent decades. To support your answer draw on evidence and/or relevant examples.

Part 5

Assume that an economy is experiencing simultaneous equilibrium in both the product market and money market. Furthermore, assume the MPC is currently around a normal level of 0.65 and the sensitivity of real money demand to also around a normal level. Based on this information, answer the following questions:

- Using the AD-AS model and the IS-LM model illustrates the impact of expansionary fiscal policy. Label the initial points in both diagrams as A and the new points following the policy change as B.

- What is meant by the term crowding out? In your answer also explain the implications of crowding out for the macroeconomy.

- If the MPC rises to 0.8 and also the sensitivity of real money demand to changes in the income rises well, use the IS-LM model to illustrate the impact of expansionary fiscal policy. Label the initial point prior to the fiscal policy as A and the new point following the expansionary policy as B.

- With reference to the diagrams you have prepared in parts 1) and 3) explain the reasons that underly differences in policy effectiveness.

Part 6

If deposits in the banking system are $540, while the reserve ratio is 0.2 and the currency to deposit ratio is 0.09, then:

- Calculate the total demand for high powered money.

- Calculate the money multiplier.

Part 7

An economy is currently experiencing inflation that exceeds the target rate set by the central bank. Answer the following questions:

- Explain the process in full detail by which the central bank can bring the inflation rate down.

- Illustrate this process from 1) using the money market model, the loanable funds the market model, and the Aggregate Expenditure model.

- Identify and explain costs to an economy that is associated with inflation.

- Identify and explain the benefits of an economy that stems from having price level stability.

Part 8

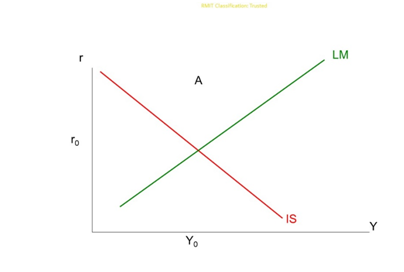

Assume an economy is currently operating at point A and answer the following questions.

- What can we draw from knowing the position of point A to understand how the product market of this economy is performing? Explain the reasoning for your answer.

- What can we draw from knowing the position of point A to understand the current state of the money market? Explain the reasoning for your answer.

- What key policy recommendations would you make for an economy like this one that is currently operating at point A? Justify why you believe this is an appropriate policy.

- Illustrate using the IS-LM model how the policy recommendations you provide in 3) will impact the economy. On your diagram indicate the new point that the policy takes the economy to and label this as point B.