Learning Outcomes:

- Explain the nature, behavior, and purpose of cost accounting, and apply cost accounting concepts, techniques, and methods to business transactions;

- Review the basic principles of accounting including the use of appropriate software

- Prepare financial statements from initial data, dealing with both routine and non-routine transactions and analyze financial statements with confidence

Task 1

Maxim commenced trading in his bakery on 5 April. All his transactions were on a cash basis, as

follows: 5 April Introduced cash into the business of £300

7 April Purchased goods for £200

8 April Received loan from Tatiana of £250 repayable within twelve months

15 April Purchased a motor van for £150

20 April Sold goods for £350

28 April Paid rent of £50

29 April Repaid part of the loan £200

30 April Drew cash from the business £60.

At 30 April Maxim had £100 goods in hand.

Required:

(a) Write up, balance, and close the relevant ledger accounts for the above transactions.

(b) Prepare the list of account balances at 30 April.

(c) Prepare the statement of profit or loss for the month ended 30 April and a statement of financial position at that date.

Task 2

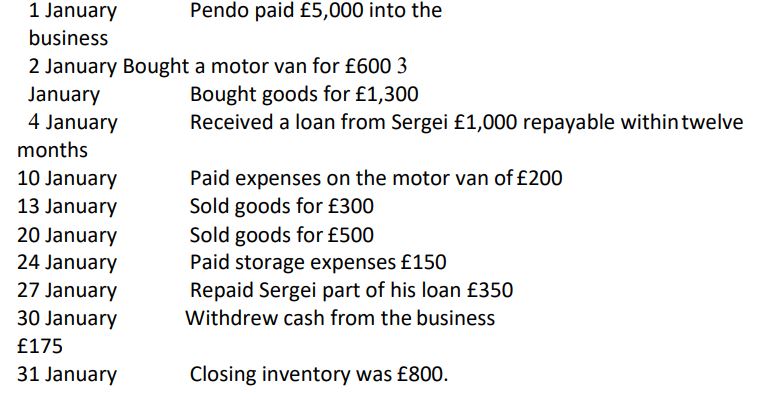

P e n d o

You are given the following information on the first month’s trading of Pendo, who is in business as a second-hand furniture dealer. All transactions are on a cash basis.

Required:

(a) Write up the ledger accounts for the above transactions, including dates, descriptions, and balances.

(b) Prepare the trial balance at 31 January.

(c) Prepare the statement of profit or loss for the month ended 31 January and a statement of financial position at that date.

Task 3

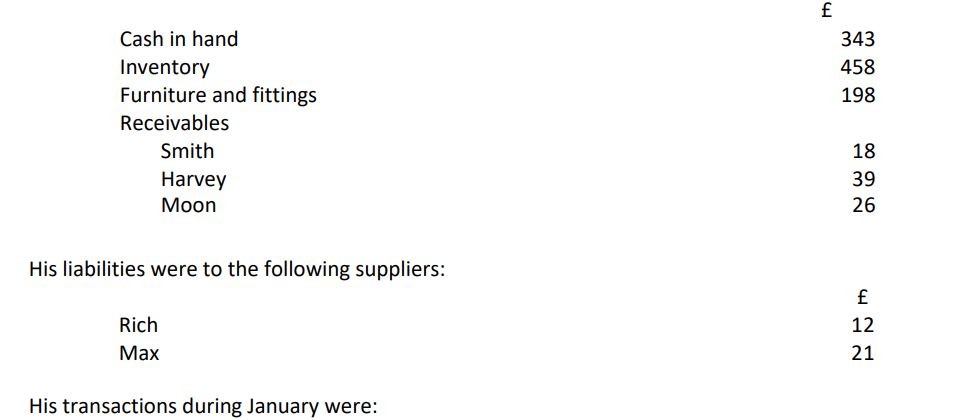

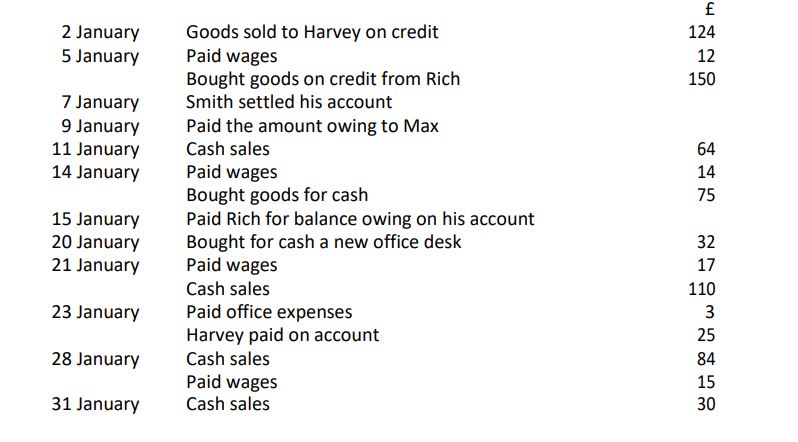

Mafuta is a retailer and on 1 January his assets were:

Inventory at cost was 374

Inventory at cost was 374

Required:

(a) Write up and close the relevant ledger accounts.

(b) Extract a trial balance at 31 January.

(c) Prepare a statement of profit or loss for the month ended 31 January and a statement of financial position at that date.

Task 4

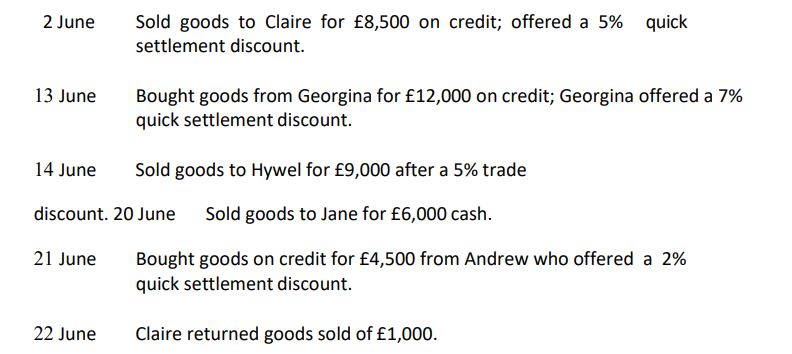

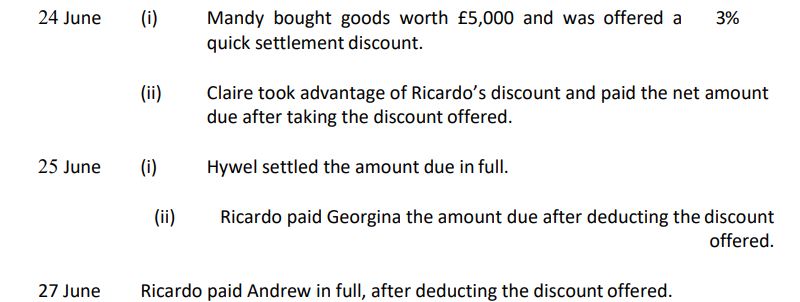

Ricardo, a sole trader, had the following transactions for the month of June:

Required:

Prepare the relevant ledger accounts to record the above transactions, extract a trial balance at 27 June and close the relevant ledger accounts.

Your answer should clearly show transactions with individual customers and suppliers.